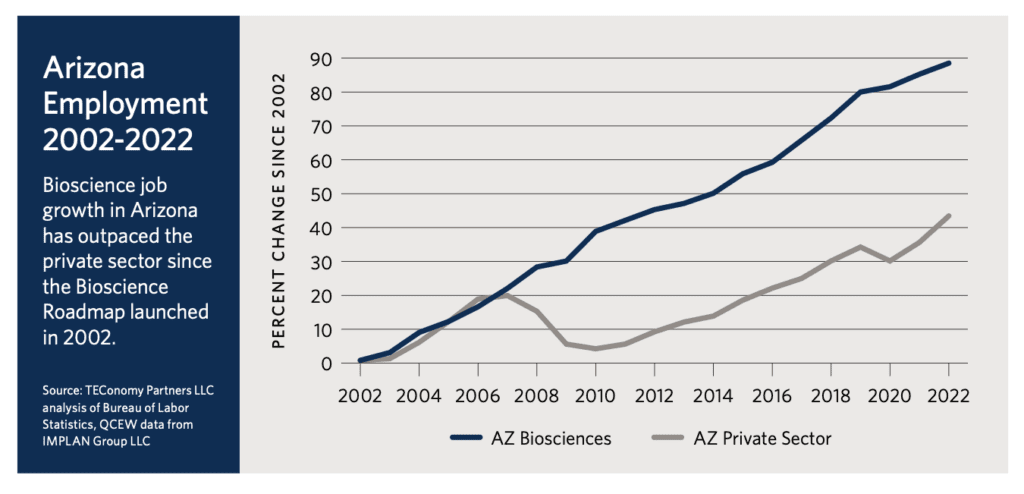

Since the launch of Arizona’s Bioscience Roadmap in 2002, the Flinn Foundation has commissioned Battelle (now TEConomy Partners) to track progress on performance measures involving the state’s bioscience sector. Data pertaining to a consistent set of metrics is gathered and reported publicly on a biennial basis.

A Roadmap progress update by TEConomy Partners in April 2024 revealed the following data—the most recent available—on key metrics.

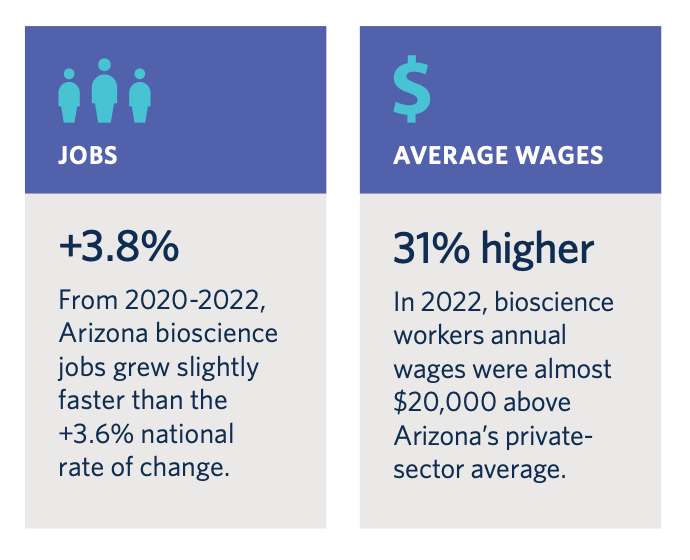

Jobs: Bioscience industry jobs increased by 14.8% between 2020-22 to 39,118, compared to the U.S. average of 11.1% growth. The number of total bioscience jobs, with hospitals factored in, increased 3.8% between 2020-22 to 138,409, slightly outpacing the national growth rate of 3.6%.

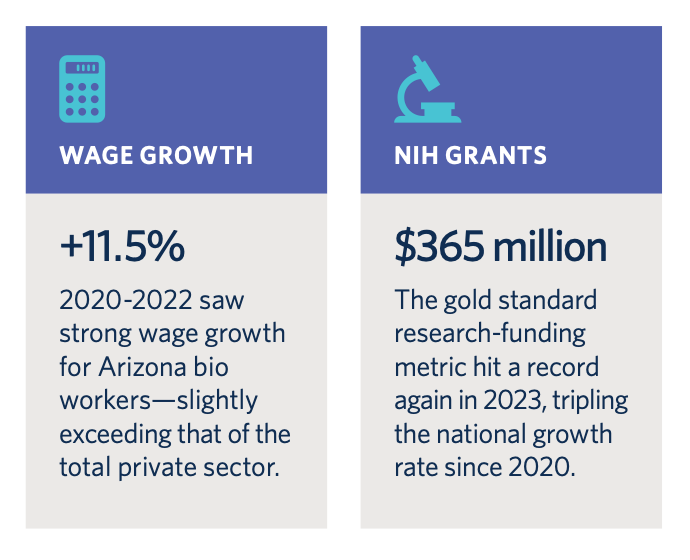

Wages: The average Arizona bioscience wage of $84,536 in 2022—an 11.5% increase—is 30.7% higher than the average private sector job in the state. For non-hospital bioscience jobs, the average Arizona wage is $99,658, an 8.2% increase over 2020.

NIH Grants: In 2023, Arizona institutions received $365 million in National Institutes of Health grants. This record-high figure has increased 29%—three times the national average—since 2020. Arizona’s percentage of nationwide NIH funding continues to increase as well and is nearing a target of 1.0% of all NIH funding. About three-fourths of the state’s NIH grants go to the state’s three public universities, followed by 20% to Arizona hospitals and research institutions..

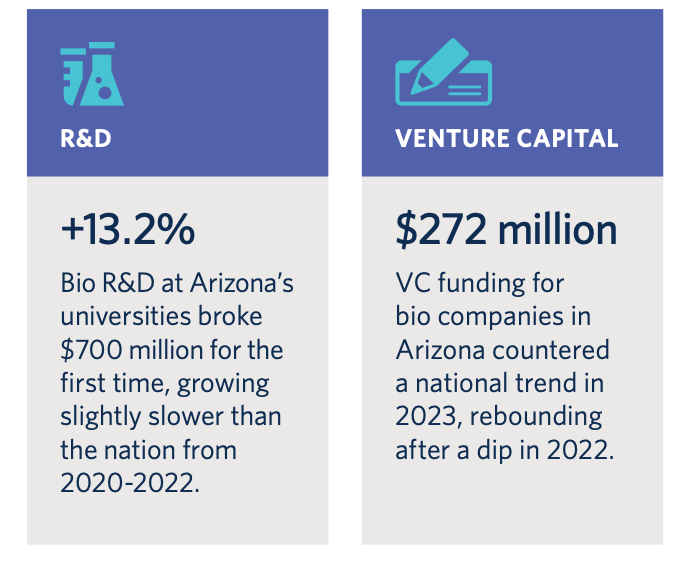

R&D Expenditures: Arizona’s academic research and development expenditures in 2022 reached a record-high $706 million, a steady increase over $642 million in 2021 and $623 million in 2020..

Venture Capital: Arizona had a dip in venture capital investment in bioscience companies in 2022 to $188 million, but responded in 2023 with an uptick to $272 million, despite the national trend continuing downward.

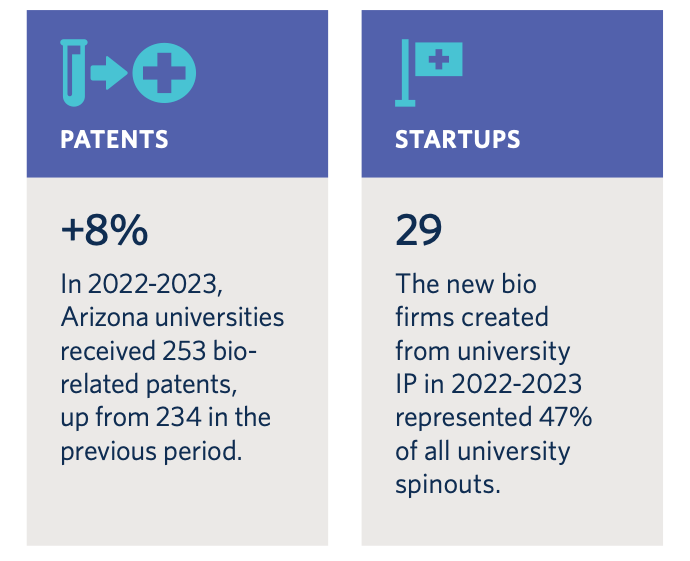

University Tech Transfer: Steady growth continued at Arizona’s public universities across a series of technology-transfer measures, though the number of university bioscience startups launched during 2022-23 dropped to 29 after reaching a record high during the previous period.

In April 2024, the Flinn Foundation hosted its annual event to share the new performance data, more than two decades after the launch of Arizona’s Bioscience Roadmap. The latest data can be found in this detailed analysis from TEConomy Partners, “Biosciences in Arizona: 2024 Performance Review.” The current and past progress reports are also available for viewing.

Data is tracked on the six industry subsectors that comprise Arizona’s definition of the biosciences. It should be noted that the industry data reflect only private industry; research-related jobs at state universities and private research institutions are not incorporated. Also, Arizona’s definition of the biosciences shifted with the updated Roadmap in 2014 to reflect changes in the national definition by Battelle and the Biotechnology Industry Organization. Thus, these industry data do not correlate directly to those from the first decade. Details are available in Arizona’s Bioscience Roadmap, 2014-2025.

Data from earlier years is available on the First Decade page.